Investment Verticals and Themes

We invest into three impact verticals, each containing their own impact themes.

-

Growth Capital

Natural Capital

Decarbonisation and Energy

Circular economy

Climate Change

Healthy communities

BSUD - Sustainable cities

-

Buy Out

Natural Capital

Decarbonisation and Energy

Circular economy

Climate Change

Healthy communities

BSUD - Sustainable cities

-

Impact Real Estate

Commercial Buildings

Regenerative Farms

Land Assets - eco tourism and education

Land Assets – Natural Capital

Sustainable Infrastructure and BSUD

Investment Mandate

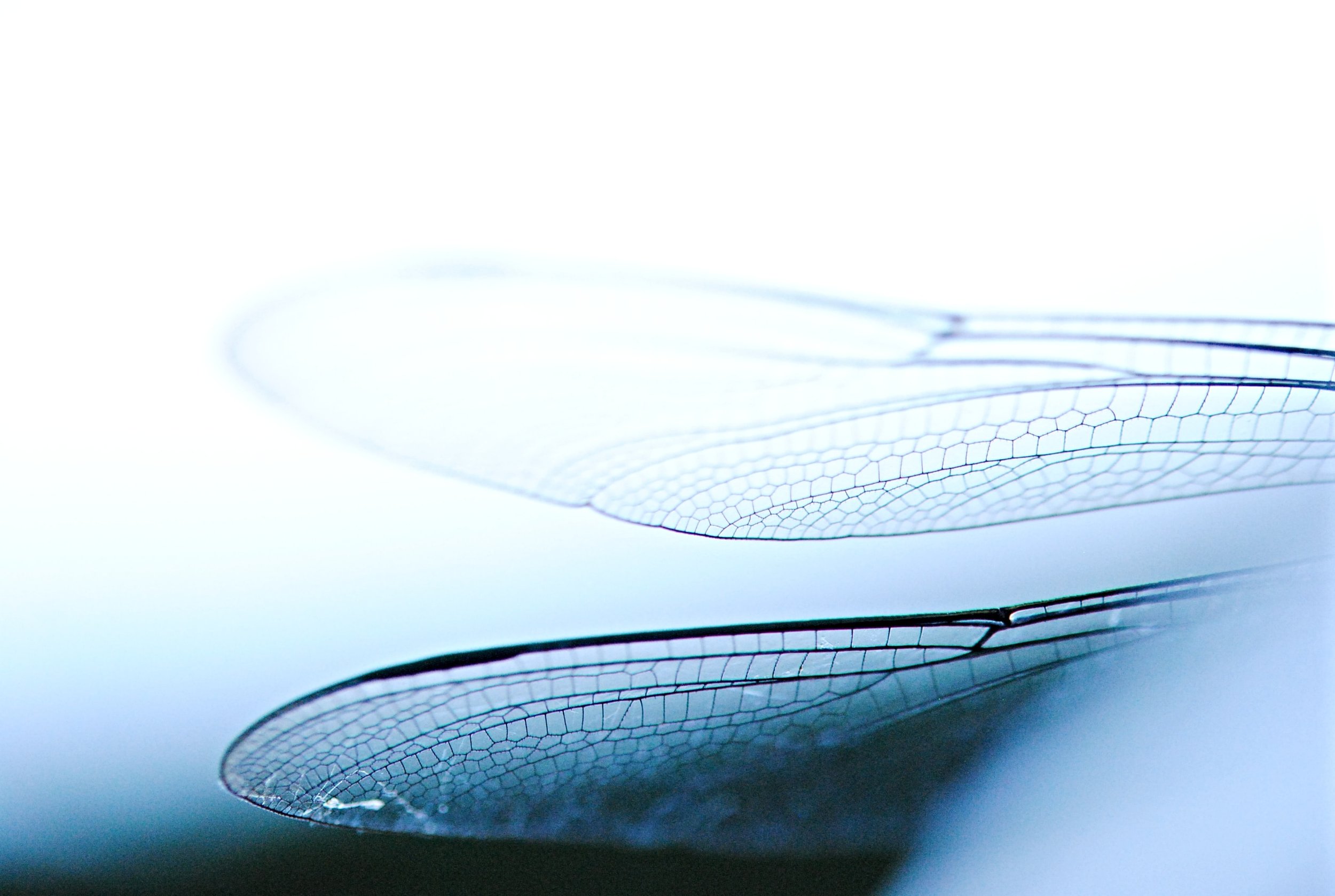

Dragonfly will always be an entrepreneurial investment manager and company, and will always seek opportunity for maximum impact and investment returns for investors. The following is the broad investment mandate, however, we may deviate from time to time, subject to an immediate opportunity.

Join the Impact Revolution - Drop us a line.

Disclaimer

Dragonfly Envirocapital Pty Ltd (CAR) is a corporate authorised representative of Boutique Capital Pty Ltd (BCPL) AFSL 508011, CAR Number 001297825.

CAR has taken all reasonable care in producing all the information contained in the website including but not limited to reports, tables, maps, diagrams and photographs.

However, CAR will not be responsible for loss or damage arising from the use of this information. The contents of this website should not be used as a substitute for detailed investigations or analysis on any issues or questions the reader wishes to have answered.

You may download the information for your own personal use or to inform others about our materials, but you may not reproduce or modify it without our express permission. To the extent to which this website contains advice it is general advice only and has been prepared by the Company for individuals identified as wholesale investors for the purposes of providing a financial product or financial service, under Section 761G or Section 761GA of the Corporations Act 2001 (Cth).

The information in this website is not intended to be relied upon as advice to investors or potential investors and has been prepared without taking into account personal investment objectives, financial circumstances or particular needs. Recipients of this information are advised to consult their own professional advisers about legal, tax, financial or other matters relevant to the suitability of this information.

Any investment(s) summarised in this website is subject to known and unknown risks, some of which are beyond the control of CAR and their directors, employees, advisers or agents. CAR does not guarantee any particular rate of return or the performance, nor does CAR and its directors personally guarantee the repayment of capital or any particular tax treatment. Past performance is not indicative of future performance.

All investments carry some level of risk, and there is typically a direct relationship between risk and return. We describe what steps we take to mitigate risk (where possible) in the investment documentation, which must be read prior to investing. It is important to note risk cannot be mitigated completely.

Whilst the contents of this website is based on information from sources which CAR considers reliable, its accuracy and completeness cannot be guaranteed. Data is not necessarily audited or independently verified. Any opinions reflect CAR’s judgment at this date and are subject to change. CAR has no obligation to provide revised assessments in the event of changed circumstances. To the extent permitted by law, BCPL, CAR and their directors and employees do not accept any liability for the results of any actions taken or not taken on the basis of information in this website, or for any negligent misstatements, errors or omissions.